Music, hello, Luan Deejay here. Let's take some time for a simple topic this week. Now I'm going to answer a common question that a lot of folks ask: how much will I make in monthly retired pay? While the true amount is calculated by the Defense Finance and Accounting Service (DFAS), or you know, for most branches anyway, except the Coast Guard, Public Health Service, and National Oceanic and Atmospheric Administration, they use the same formula but there are different agencies. I can show you a quick way to get a basic idea of what your pay will be. This episode will only cover how to calculate retirement pay under the current or soon-to-be legacy retirement plan. There is a slightly different method for the new blended retirement system coming into effect next year. I'll cover that in a future episode. Last week, I covered how to read an Army National Guard retirement point statement. Don't worry, all the other branches, I will do the same for your statements in time. For now, all you need to know is how many creditable points for retired pay you have earned. There is a little math here, but it's not too bad. The basic formula is points divided by 14,400 multiplied by base pay. Consider the points and divide by amount in parentheses for this model. Here's how it works. As I said before, find the creditable points you have earned and write it down. Divide that number by 14,400. This will give you a percentage. Write down this percentage in your notes. Now find your rate of monthly base pay for your pay grade and years of service. I've got a link to the 2017 pay chart down below if you need help. Put that rate of pay into your...

Award-winning PDF software

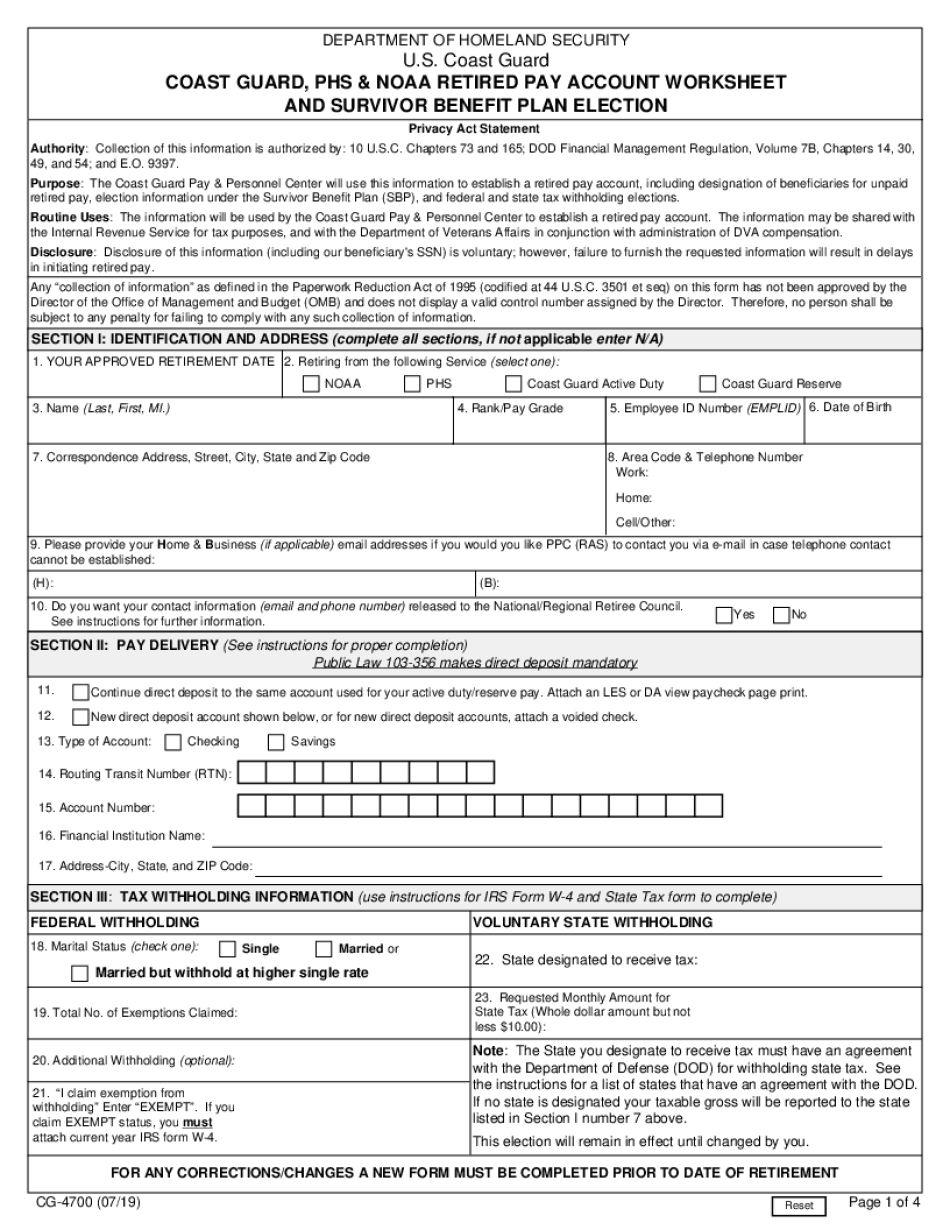

Coast guard retirement calculator Form: What You Should Know

This page also lists Pay Tables and Salary Calculator form and calculator references. U.S. Coast Guard Pay Charts This section will help you determine your current pay and what's in store for you. Pay Rates and Rates Notations Pay Rate Conversion Tables Forms and Worksheets This section contains free Form and Worksheet templates to generate the charts. Retirement Point Pay Calculation Using the Calculator for United States Coast Guard Retirement Rates U.S. Coast Guard Pay Tables and Salary Calculators Coast Guard Pay Calculator This calculator can be used to determine the current Pay Table or salary levels for new hires, retirees and annuitants. Current Pay Rates and Rates Notations This section will help you determine current Pay Rates & Notations. Pay Tables and Salary Calculator forms and calculator references This section lists forms and worksheets referenced for the following types of pay tables and salary calculators: Retired Pay Calculator For the purpose of this calculator, the retired pay multiplier is equal to the retirement age divided by the number of years of service divided by four. Coast Guard Retirement Calculators For additional retirement calculator reference and charts click to these links: SIC Program Call This site contains a calculator that is used for determining the U.S. Coast Guard's SIC Program payment from retirement. Calculating U.S. Coast Guard U.S.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do USCG CG-4700, steer clear of blunders along with furnish it in a timely manner:

How to complete any USCG CG-4700 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your USCG CG-4700 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your USCG CG-4700 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Coast guard retirement calculator