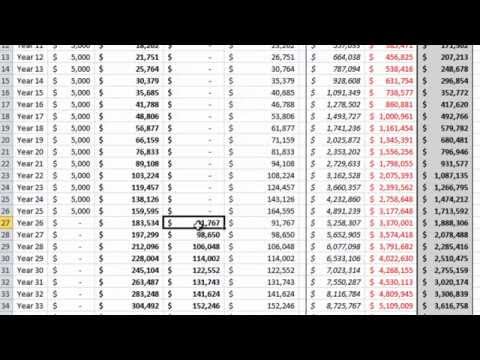

Hey there, this is Seth. I want to show you this Excel spreadsheet that I created last week. The purpose of this spreadsheet is to help real estate investors calculate their path to retirement. To demonstrate how it works, let's start with the assumptions. The first assumption is the annual return on investment (ROI). This represents the cash on cash return we expect to receive from all our real estate investments throughout our investing career. For this example, let's assume it's 15%, which is quite good. Next, we have the principal invested. This means that every year, we will invest $5,000 of new money into our portfolio. Moving on, we have the interest rate. This is the rate we will need to pay on the mortgages we take out for each property. Let's assume it's consistently 5% for every property, although this may be a bit optimistic. Feel free to change it to a more realistic rate if you wish. Then, we have the mortgage term. Assuming we will be taking 30-year mortgages for all the properties we buy. Next, we have the injection amount. This represents the assumption that for every property we purchase, we will need to inject at least 25% of the purchase price. This is a conservative estimate, as sometimes you won't need to inject that much. However, it's good to keep it on the conservative side, especially when buying multi-family real estate investments. In contrast, we have the mortgage amount. When we enter 25% in the injection amount, the mortgage amount will automatically fill in the remaining 75% of the purchase price. For example, if we change the injection amount to 20%, the mortgage amount would be 80% of the purchase price. Lastly, we have the number for the withdraw for a living. This represents the amount we will live on...

Award-winning PDF software

New military retirement calculator Form: What You Should Know

Military Retirement Calculator | Department of Veteran Affairs Military retirement calculators for military retiree, Thrift Savings Plan, Military Income, etc.

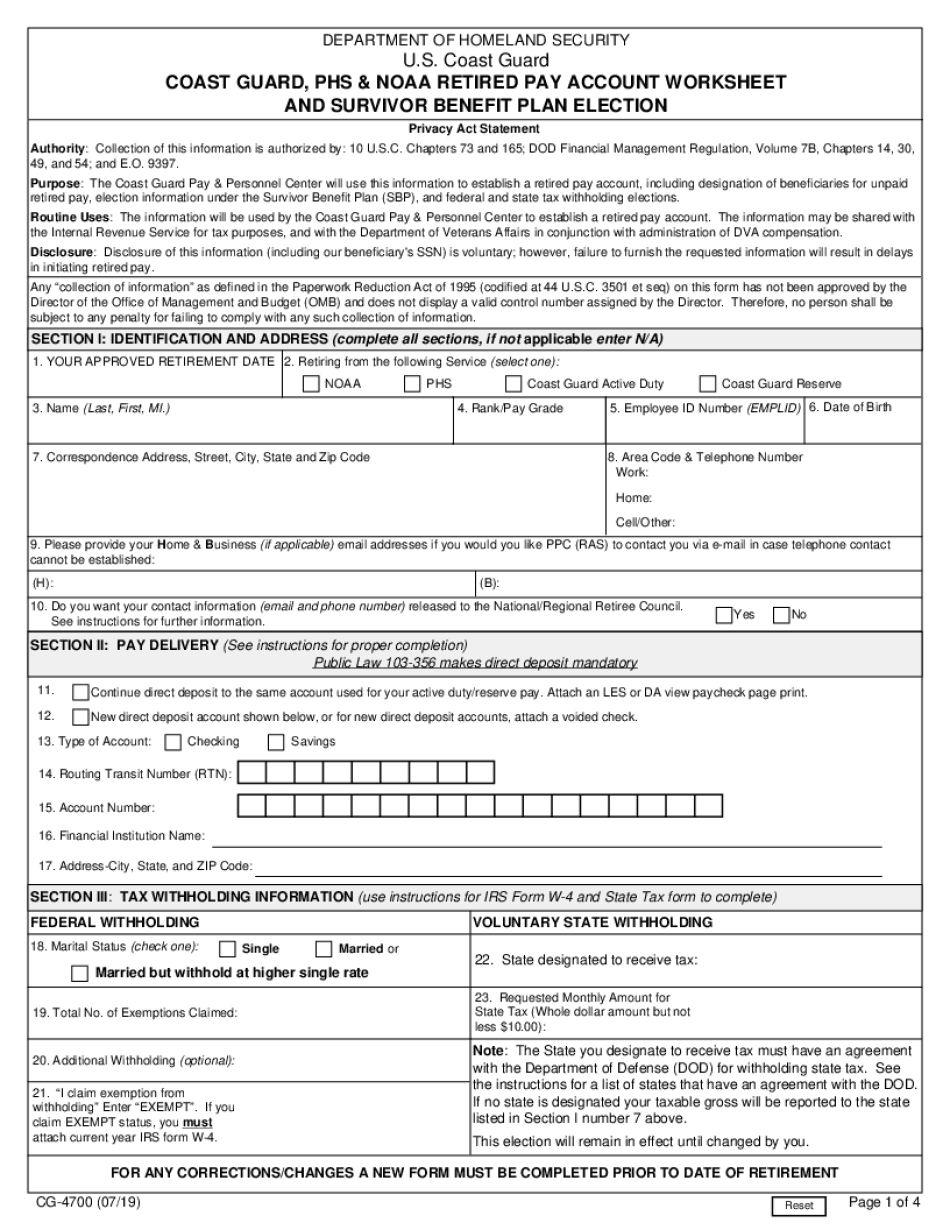

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do USCG CG-4700, steer clear of blunders along with furnish it in a timely manner:

How to complete any USCG CG-4700 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your USCG CG-4700 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your USCG CG-4700 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing New military retirement calculator