Submarines. I'm starting at Dallas, and the goal of this video is to shed some light on just how valuable Marine Corps retirement actually is for both active duty and the reserves. We get down to the actual dollar amount of what your time served is worth on paper, so try to stick with me as I break it down real fast. Active duty retirement is pretty cut-and-dry. After 20 years of service, you're gonna retire at 50 percent of your base pay. At 30 years, it's 75 percent. In a nutshell, the longer you overshoot that 20-year mark, the higher percentage of your base pay you're gonna receive month after month. So here's your typical what-if scenario: after 20 years of service, you retire at the pay grade of e8 with a monthly retirement of $2,429. Now, let's add on an additional four years to that hypothetically, and you get promoted to the pay grade of D 9. You just increased your annual retirement by an additional $14,000. Another scenario: after 20 years of service, retiring at the pay grade of O five would yield you a monthly retirement of $4,178. Adding two more years to that will yield you an additional $6,500 a year. These numbers are based on the 2016 pay scale and have kept up with inflation since 1949. Reserve retirement is much different because it's based on points. You'll need a minimum of 50 points per year to qualify for a satisfactory year. The biggest difference is that you start drawing retirement at age 60 or much sooner depending on how long you're mobilized for during that time period. During a typical drill weekend, you'll earn an average of 46 points. You'll also earn credit for any kind of online correspondence or PME. And then...

Award-winning PDF software

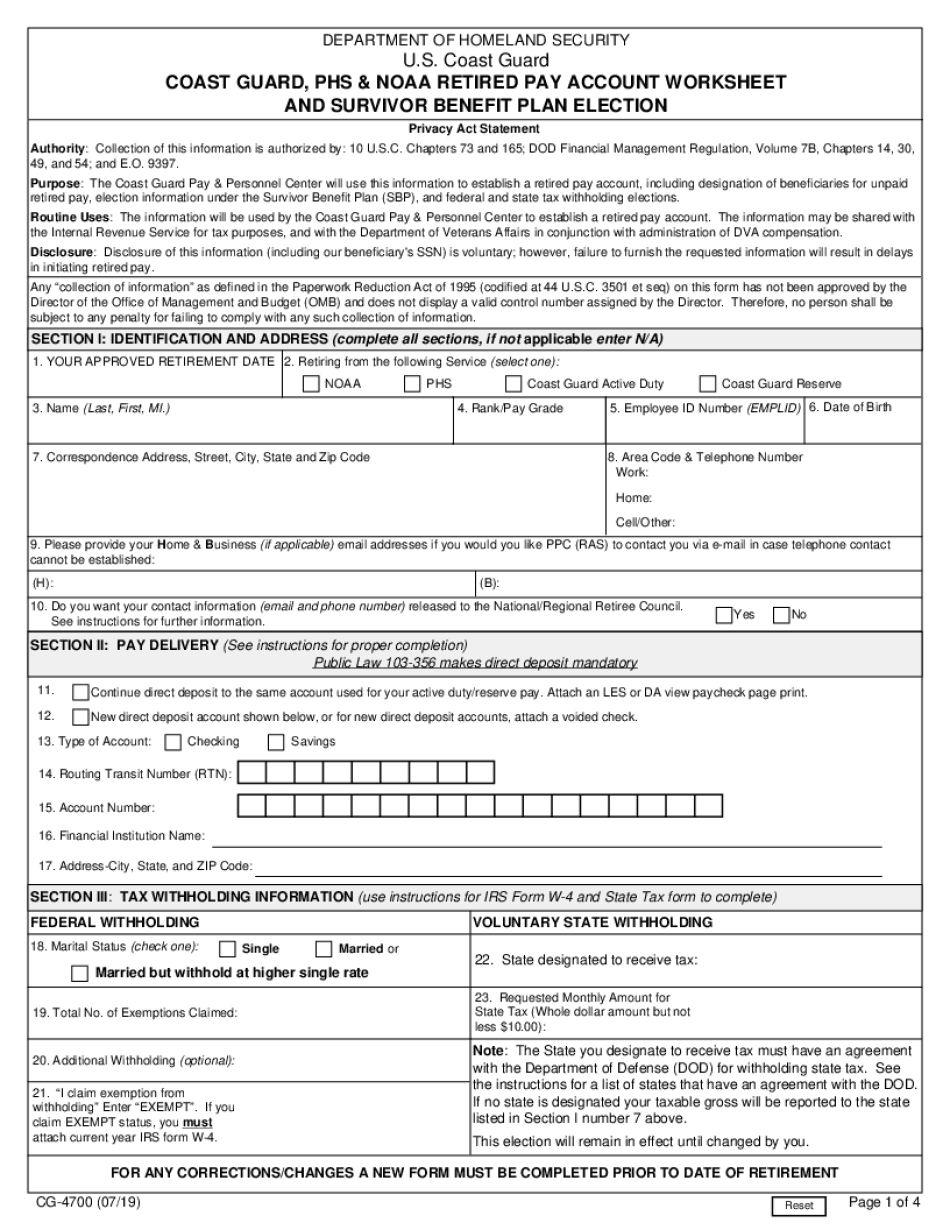

Coast guard reserve retirement benefits Form: What You Should Know

A retired Coast Guard officer whose active service time in the armed forces was more than five years; or is now receiving a pension or annuity from the U.S. Public Health Service or the Veterans Administration; or retired from the armed forces; or has less than 5 years of active service and a “good cause” for the absence; or is a person of a former race and color who was previously employed in the Coast Guard and was discharged as a non-commissioned officer, warrant officer or enlisted man from the Coast Guard for misconduct or misbehavior; or has not received payment of benefits for the disability from any source other than the U.S. government; or has received payments of disability retirement benefits from any source other than the U.S. government. Retired member who served in the Coast Guard for ten years and retired because he or she retired, due to disability while in active duty, or due to a medical retirement from active duty; Retiree and Annuitant who retired from the Coast Guard because he or she, because of a disability, has received payment for retired pay; or has been appointed to or had retired pay transferred to: an Office of the Public Advocate in the United States Department of Justice; or a United States Government pension agency. Retired pay is for 1 year under the following circumstances: A retired officer is receiving a pension for a medical separation for a service-connected disability. Under §7C.30, if the pension is due to a medical separation, or any separation incident to separation of 1 year or more occurring in the uniformed service, the retired officer may receive a transfer of the retired pay to an account designated for medical disability retired pay; or A retired officer is receiving a pension for a separation incident to separation of 1 year or more occurring in the uniformed services. Under §7C.5(e)(2), if the pension is due to a separation incident to separation of 1 year or longer existing in the uniformed service, the retired officer may receive a transfer of the retired pay to an account designated for separation-related retired pay. Retired pay has not been received from any other account in the pension system. The retired pay is payable from the first day of the month in which the retired officer begins receiving compensation from the pension system. The retired pay is payable monthly or if longer than 1 year as soon as an application for receipt is received from the retirement system. (See CG-2055-A.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do USCG CG-4700, steer clear of blunders along with furnish it in a timely manner:

How to complete any USCG CG-4700 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your USCG CG-4700 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your USCG CG-4700 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Coast guard reserve retirement benefits